Wazzup Pilipinas!

Who else should primarily benefit from businesses owned by Filipinos but their own fellow Filipinos. Thus, many should be excited about this new firm that is about to launch as well in the Philippines.

As the saying goes, love local - prioritizing every Filipino-made brand, product or service, to primarily patronize the brands made in the Philippines. Thus it goes the same for entrepreneurs or businessmen to put into consideration giving the Filipinos the most opportunity to gain the best possible benefits out of Philippine-owned firms.

Rommel Santos is Philippine-born and he may be Australia-based but the Smart Asset Managers (SAM) founder and entrepreneur, said that his company, is a subscription-based firm that aims to revert to the conventional method of entrepreneurial journey through sharing economy, and this means that he also pushes for the creation of a cooperative wherein every subscriber automatically becomes a member of a coop.

"…… the State shall recognize cooperatives as associations organized for the economic and social betterment of their members, operating business enterprises based on mutual aid, and founded upon internationally accepted cooperative principles and practices” as per Republic Act 6939 that created the Cooperative Development Authority (CDA).

Santos wants SAM subscribers to be covered by a cooperative so Filipinos will benefit from whatever profit SAM will gain.

For now, a subscriber of 300USD gets rewarded of up to 15% monthly distributed daily to his SAM E-wallet account. It entails pre-development capital raising.

With a subscriber’s coop membership, he then has the sense of ownership or belongingness. Another is for Filipinos to have the income opportunity or beneficiaries are the general public.

AsTAs mentioned, the Melbourne, Australia-registered firm will soon have a grand launch in the country after settling all its amenabilities and formalities with the Philippine government.

Santos says that Smart Asset Managers Project Developments (SAMPD), wants to disrupt a long-going business practice of some foreign companies operating in the Philippines “where they write off or deduct their taxes by bringing out money from the Philippines to avoid paying appropriate local taxes should which should not be the case. "Let the benefit go where it should,” he explains. “We are not after any tax holidays, tax breaks or tax reliefs.” Santos has long announced that he wanted to contribute to bring positive changes to Filipinos’ financial state.

Especially now that the Philippine economy needs a big boost during the Covid-19 Pandemic when many businesses have either closed down or laid-off their employees, we have to commend the founder for such an honorable endeavor.

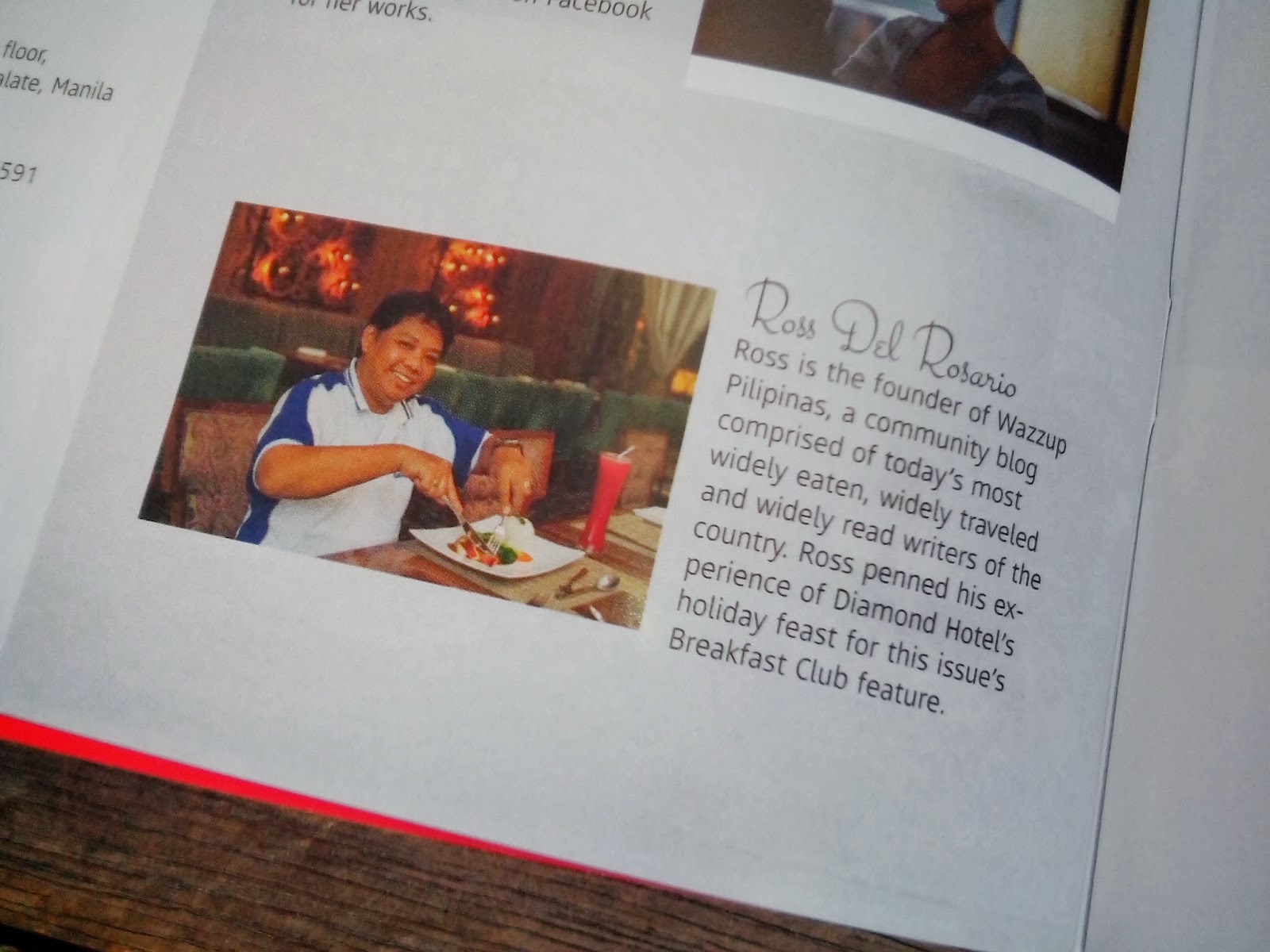

Ross is known as the Pambansang Blogger ng Pilipinas - An Information and Communication Technology (ICT) Professional by profession and a Social Media Evangelist by heart.

Ross is known as the Pambansang Blogger ng Pilipinas - An Information and Communication Technology (ICT) Professional by profession and a Social Media Evangelist by heart.