Wazzup Pilipinas!

The homegrown real

estate brokerage and consulting firm highlights key market indicators that

defined the country’s real estate market in 2018 and what will shape 2019

January 23, 2019;

Manila: The TRAIN Law, the government’s “Build, Build, Build” program, adjustment

of price ceilings for socialized and low-cost housing—these are some of the

real estate market indicators that defined 2018 and what will shape the market

in the years to come, as reported by Pinnacle

Real Estate Consulting Services, Inc. in its latest research.

Here are the major highlights of Pinnacle’s latest report.

2018 Highlights

1. TRAIN Law and Real

Estate

The Tax Reform for Acceleration and Inclusion (TRAIN) Bill

or the Republic Act 10963 took effect on the first day of 2018, whose main

purpose is to implement revisions in the Philippine internal revenue tax

system, thus providing additional disposable income to working Filipinos.

Aside from this, there were also allied gains in the taxes

involving real estate transactions. Some of these are the rate-reduction and

simplification of the estate and donor’ tax systems and value-added tax base

expansion affecting socialized and low cost housing segments, residential

condominium dues, residential leasing, and the much-delayed Real Estate

Investment Trust.

It is also said that 70% of the revenues from the TRAIN Law

shall be used to fund the infrastructure projects of the government.

2. Infrastructure

Gains for Real Estate

The government continues to invest heavily on projects under

the “Build, Build, Build” program. As of 30 November 2018, the National

Economic and Development Authority (NEDA) approved 35 infrastructure flagship

projects with an estimated cost of Php1.537 trillion. This is in line with the

current administration’s policy to undertake a minimum of Php1 trillion worth

of infrastructure projects per year until 2022.

On top of the list is the Php357-billion Metro Manila Subway

Project – Phase 1 funded by a loan from the Japanese government. This

25.3-kilometer underground commuter rail system will from Quezon City to Taguig

City with an extension going to the Ninoy Aquino International Airport.

3. Adjustment on

Price Ceilings for Socialized Housing

In 2018, the Housing and Urban Development Coordinating

Council (HUDCC) issued House Resolutions Nos. 1 and 2 to increase the price ceiling

for socialized subdivision and socialized condominium housing projects,

respectively. The adjusted price ceiling for horizontal socialized housing

projects now range between Php480,000 and Php580,000.

Price ceiling for vertical socialized housing or socialized

condominium projects is between Php700,000 and Php750,000 for Metro Manila and

selected nearby areas, and between Php600,000 and Php650,000 for other areas.

There were no existing or separate housing ceiling under this category.

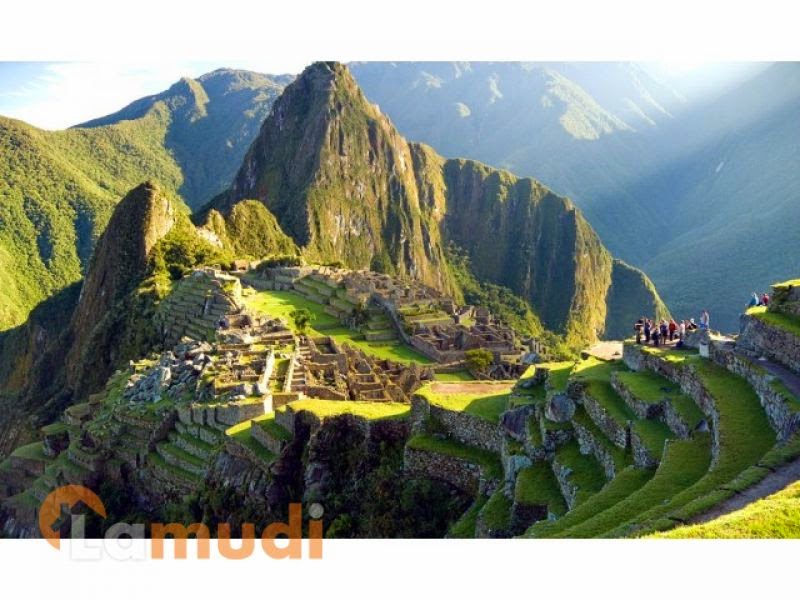

4. Boracay Closure

In April 2018, the government ordered the closure of Boracay

for a period of six months to rehabilitate the island. Fast forward, Boracay reopened

to the public in October 2018, but the government has now enforced stricter

rules and regulations in the operation and maintenance of the island in order for

its tourism industry to be sustainable. Major changes are the reduction of the

daily tourist capacity and accreditation of resorts, hotels, and other lodging

facilities ensuring they are environment-friendly before they operate.

The closure and rehabilitation of Boracay may have

encouraged sustainable and responsible tourism as the government is closely

monitoring the situation in El Nido and Coron in Palawan, Puerto Galera in

Oriental Mindoro, and Panglao in Bohol.

5. New Manila

International Airport in Bulacan

The 50-year concession agreement for the New Manila

International Airport finally got the approval from the National Economic and

Development Authority. San Miguel Holdings Corporation (SMHC), a subsidiary of

San Miguel Corporation, submitted the unsolicited proposal for the

construction, operation and maintenance of the airport.

The project will be constructed in a 2,500-hectare land in

Bulakan, Bulacan with an estimated project cost of Php735.6 billion. Once

completed, the airport will have a passenger capacity of 100 million a year

which is thrice the passenger capacity of the Ninoy Aquino International

Airport.

2019 Indicators

1. Updates on REITs

The Securities and Exchange

Commission (SEC) and the Bureau of Internal Revenue (BIR) have made moves to

dismantle two roadblocks that hinder the full implementation of the REIT Law.

The SEC, for its part, has agreed to lower the minimum public ownership (MPO)

to 33%, provided that the BIR clarifies that initial transfers of property to

REITs are exempt from VAT as provided by the TRAIN Law. Statement from BIR

Commissioner Caesar R. Dulay affirm that the interpretation of the TRAIN Law,

saying that the initial property transfers to REITs are VAT-exempt as long as

they qualify under Section 40(C)(2) of the 1997 tax code.

2. TRABAHO Bill

The Tax Reform for Attracting Better and High-Quality Opportunities (TRABAHO)

Bill or the second package of the TRAIN (Tax Reform for Acceleration and

Inclusion) Law was approved on third and final reading at the House of

Representatives. As its title suggests, its objective is to generate better and

high-quality employment opportunities by attracting new business and

investments through reduction of their corporate income tax (CIT). The

Philippines has the highest CIT among ASEAN countries at 30%. Singapore, which

we could say as the most business-friendly state in the region, has a CIT of

only 17%.

3. Cebu Continues

Winning Form in the Tourism Sector

The second most important metropolitan area in the

Philippines, Cebu has a prosperous tourism industry, and the opening of the

Mactan-Cebu International Airport (MCIA) Terminal 2 has been a game changer and

only bolstered the province’s position as one of the country’s top tourist

destinations, according to the Department of Tourism (DOT). MCIA data shows

that there were 1.4 million foreign tourist arrivals in Cebu from January to

September of 2018, which is 22.76% higher than the figure recorded for the same

period in 2017.

Another industry that Cebu should focus on is the MICE

(meetings, incentives, conventions, and exhibitions) industry, according to DOT

chief Bernadette Romulo-Puyat. Two major international events will be held in

Cebu this year: Routes Asia 2019 and Centre for Aviation’s (CAPA) LCCs in North

Asia Summit. Cebu is a perfect target for big-ticket and high-profile events

because of its touristy ambiance and its new airport terminal. These events are

also expected to boost Cebu’s hotel occupancy this year.

4. Bay Area Continues

Uptrend

With a condo stock of approximately 20,000 units as of 2018,

the Bay Area has already surpassed Ortigas Center as Metro Manila’s third

largest condo submarket, and is expected to overtake the Makati central

business district as the capital’s second largest condo submarket. Meanwhile, the

Paranaque side of the Bay Area will soon have its own anchor retail tenant when

the Ayala Mall Bay Area beside the City of Dreams Manila opens sometime in

2019.

Touted as one of the biggest Ayala malls, foot traffic will significantly

increase on this side of Entertainment City, and will have a significant impact

on the resale price of condos near it. In addition, office rental rates in the

Bay Area have already breached the Php1,000 per square meter per month mark, on

par with rental rates of Grade A offices in the Makati CBD.

5. Central Luzon as

New Growth Area Outside Metro Manila

The current administration’s goal of spreading business

opportunities outside Metro Manila is definitely spilling over to Central

Luzon, most notably the areas within and around the Clark Freeport Zone. This

development is boosted by several planned transport infrastructure projects

that will improve the region’s connectivity.

One of these is the ongoing expansion project of the Clark

International Airport, the first phase of which is scheduled for completion in

June 2020, and involves a new 100,000-square-meter terminal being built by

Megawide-GMR consortium and is expected to increase Clark’s capacity to 8

million passengers per year. Second in the government’s list is the Subic–Clark

Cargo Railway, which will provide freight service between the Subic Bay

Freeport Zone and the Clark Freeport and Special Economic Zone.

Several national real estate players are seen to benefit from

these ongoing developments, most notable of them include the Filinvest group,

Dennis Uy’s Global Gateway Development Corp. (GGDC) with its Clark Global City,

and SM Prime. Recently, GGDC has engaged the SM group to be the first anchor

locator in Clark Global City. Pinnacle data shows a burst of activities in

Central Luzon, most notably Mabalacat, Mexico, San Fernando, and Porac in

Pampanga, LGUs that surround Angeles City.

6. Davao as the Next

‘It’ Destination for Investment

One of the most exciting places in the Philippines at the

moment, Davao City and the larger Davao Region will be the place to be this

year. One of the region’s major draws is the planned transport infrastructure

projects aimed at mitigating congestion in Davao City itself and improving

transportation logistics for the whole Davao Region.

Foremost is the construction of the 44.6-kilometer Davao

City Bypass Road that will commence in 2019. This ambitious project will

include a tunnel section and will start from the Davao–Digos of the

Pan-Philippine Highway in Toril and will terminate intersecting the

Davao–Agusan National Highway in Panabo City.

The city’s airport will also receive a much-needed upgrade

soon, thanks to the Davao Airport Operations, Maintenance and Development

Project that will start in 2019. Once completed, the airport’s design capacity

will be increased 500% to 17.9 million passengers per year. Data shows that in

2017, the airport handled 4,234,667 passengers, way above its design capacity.

With key infrastructures set to be delivered over the next

few years, property developers have been very busy changing the landscape and

skyline of Davao City dramatically. A multitude of property giants are bringing

their unique and different brands into the real estate market of the city. One

of the most anticipated developments is Ayala Land’s Azuela Cove and

Megaworld’s Davao Park District.

7. The Rise of Condo Submarkets

Outside Traditional CBDs

With land prices in the Makati central business district and

Bonifacio Global City scarce and prohibitively costly, developers are venturing

out of the traditional business districts for their next Metro Manila projects.

The Chino Roces area over the next few years will be a thriving condo

submarket, similar to the north of Ayala area, while Ayala Land and Lucio Tan’s

Eton Properties recently entered into a partnership to develop Parklinks, a

35-hectare master-planned project along C5 Road between Pasig and Quezon City

(close to Eastwood City).

About Pinnacle Real Estate Consulting Services, Inc.

Pinnacle Real Estate Consulting

Services, Inc. is a home-grown real estate brokerage and consulting firm. It

provides a full range of services to local and foreign investors, buyers, and

real estate lenders. It is composed of a team of experienced professionals

dedicated to enhancing the value of client investments throughout the

Philippines.

The company’s primary business lines are real estate asset

management and brokerage, real estate closing and advisory services, property

appraisal, research and consulting, property and facilities management, and

non-performing loan (NPL) asset management, among others.

Ross is known as the Pambansang Blogger ng Pilipinas - An Information and Communication Technology (ICT) Professional by profession and a Social Media Evangelist by heart.

Ross is known as the Pambansang Blogger ng Pilipinas - An Information and Communication Technology (ICT) Professional by profession and a Social Media Evangelist by heart.