Wazzup Pilipinas!?

Following Citigroup's major exit across various APAC markets including the Philippines, Union Bank of the Philippines (UBP) officially takes over Citi's consumer banking business in the country.

From potential seller to now the buyer, the Aboitiz family is beefing up its banking biz.

It wasn't so long ago when selling Unionbank was on the radar. UnionBank bested other suitors to acquire Citigroup's consumer banking biz in Philippines.

Union Bank of the Philippines is taking over American banking giant Citigroup Inc.’s consumer banking business in the Philippines. UBP will buy Citigroup's consumer banking business in the country for at least 45.3 billion pesos ($908 million).

"UBP was selected by Citi following an extensive and competitive auction process," says the American bank giant, stressing there will be no change in their service to customers during the transition to the agreement’s closing.

UBP has entered into a Share & Business Transfer Agreement with various subsidiaries of Citi which includes Citi’s credit card, personal loans, wealth management, & retail deposit businesses, as well as Citi’s real estate interests in Citibank Square (Eastwood), 3 full-service bank branches, 5 wealth centers, & 2 bank branch lites.

UnionBank says the acquisition will be funded by a combination of internal resources, stock rights offering (SRO)

UnionBank: The Bank’s key shareholders – Aboitiz Equity Ventures, Insular Life Assurance, and Social Security System – are fully committed to the SRO.

To recall, the banking giant earlier this year, on April 2021, said it will be leaving 13 APAC markets. It will continue its corporate banking presence in the Philippines.

The transaction with Citi is expected to close in the second half of 2022 and will be funded mainly by a stock rights offering, and is subject to regulatory approvals (BSP Monetary Board, PCC, PDIC, SEC, IC).

Citi will keep running its PH consumer banking business until the acquisition's completion, it adds.

UnionBank also sought a trading halt until 10:30am to give investors 'time to clearly understand and absorb' its announcement on the acquisition of Citi's PH consumer banking business.

About 1,750 employees are expected to transfer to the new owner.

Citi Philippines assures its customers that the development will have no immediate impact on their accounts, deposits, investments, credit cards, or any other services.

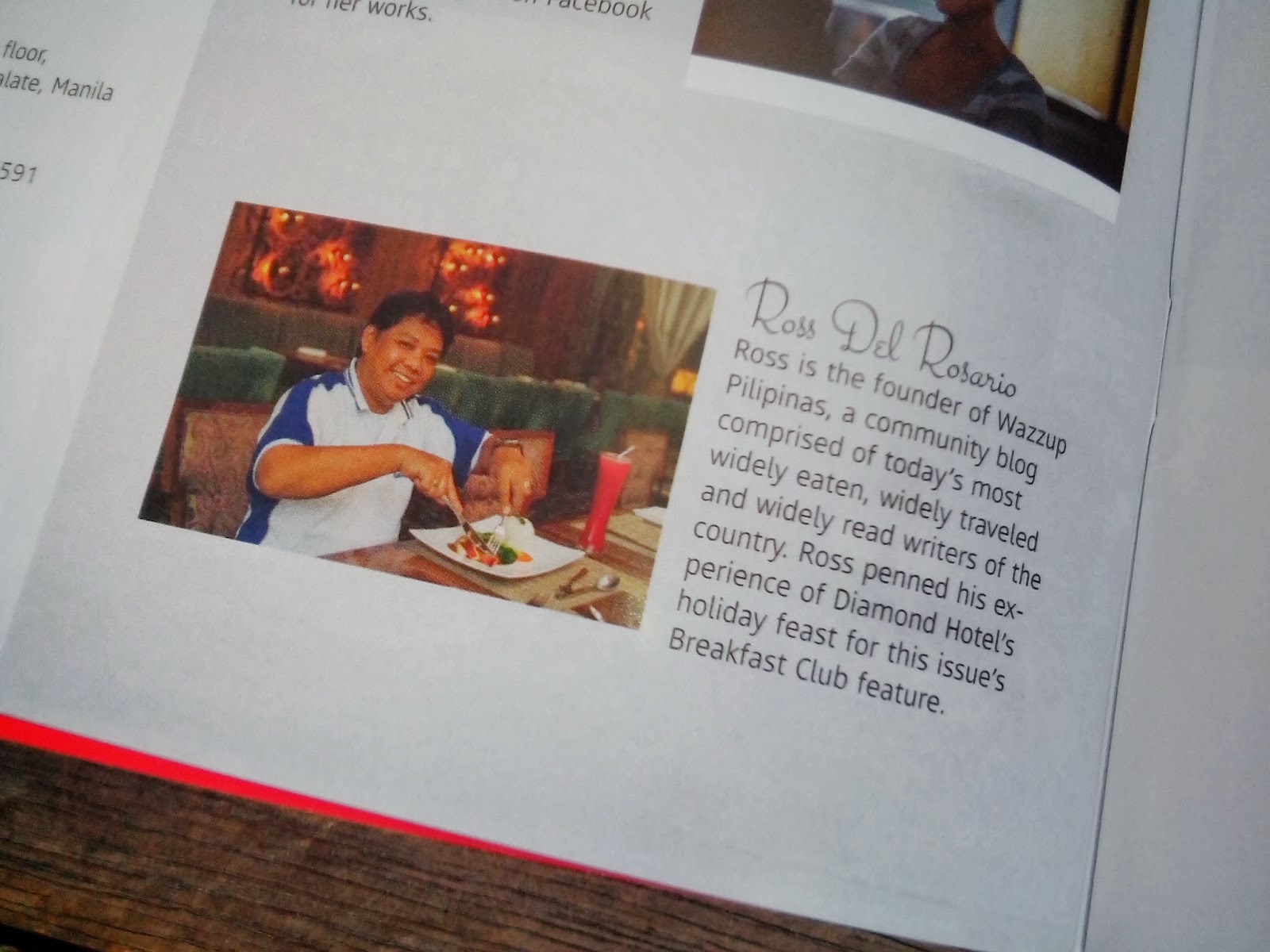

Ross is known as the Pambansang Blogger ng Pilipinas - An Information and Communication Technology (ICT) Professional by profession and a Social Media Evangelist by heart.

Ross is known as the Pambansang Blogger ng Pilipinas - An Information and Communication Technology (ICT) Professional by profession and a Social Media Evangelist by heart.

I have been using different banks for different needs for a long time. In one I keep funds on deposit at a small annual interest, in the other I just have a savings account for physical assets like gold and silver. It seems to me that if you are also looking for a bank where you could keep your funds, then pay attention to the reviews on https://metabank.pissedconsumer.com/review.html and read what other clients of this bank write to understand how they work with clients and what kind of relationships they build with them.

ReplyDelete